Travel Money Cards

Travel cards are a secure, flexible and cost-effective way to manage your money abroad.

Pros of Travelling with a Travel Card

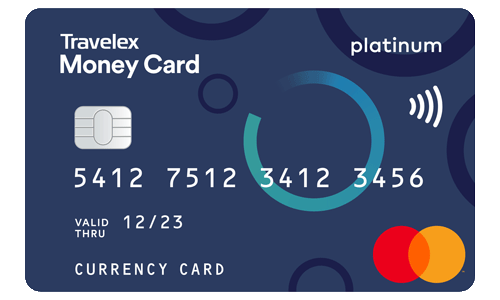

Load Multiple Currencies: Unlike debit or credit cards, some travel cards allow you to load multiple currencies onto the one card. The Travelex Travel Money Card lets you load up to 10 different currencies, making it easier to manage funds across multiple destinations. Plus, you can easily manage your travel money on the go with the Travelex Travel Money App. See our travel money cards comparison.

Locked-in Exchange Rate: Travel money cards allow you to lock in one exchange rate at the time of purchase. This means you know exactly how much you’ve paid and you won’t need to stress about exchange rate fluctuations affecting your holiday budget on your trip.*

No Foreign Currency Conversion Fees: The Travelex Travel Money Card lets you exchange currencies with no currency conversion fees, unlike with a debit card, so you can stretch your Australian dollars even further.

No International ATM fees: There are no fees when you withdraw cash from an international ATM with the Travelex travel money card. Some cards offer no international fees. While regular ATM withdrawal fees may apply, none will be charged to your card by Travelex, which often happens when using a debit or credit card internationally.

Cons of Travelling with a Travel Card

Not all Destinations and Experiences Accept Card: Not all destinations or vendors will accept travel money cards as a form of payment. Because of this, it may be a good idea to have some cash on hand to avoid tricky situations where your prepaid card may not be accepted.

Fees: There may be fees associated with certain travel cards1. These can range from fees to load and reload your card, purchase fees, issue fees, and fees when you decide to cash out any remaining balances. Make sure you compare cards online, and are fully aware of any fees which may apply. Here are the fees and limits that apply to the Travelex travel card.

Fees: Depending on the provider, some travel money cards come with fees1. These can range from fees to load money, purchase fees, issue fees, and additional fees when you decide to cash out any remaining balances. Make sure you compare cards online, and check the fine print. Here’s a breakdown of the Travelex Travel Money Card fees.